The Hidden Estate Tax Trap for Expats Holding U.S. Shares

Many expatriates invest in U.S. companies ,whether directly through a brokerage account, via an online trading app, or through U.S.-listed ETFs and funds.

The appeal is obvious: access to global blue-chip companies, deep liquidity, and a vast choice of sectors.

However, there’s a little-known tax rule that could catch your family off guard if you pass away while owning U.S. shares — U.S. estate tax.

What is U.S. Estate Tax?

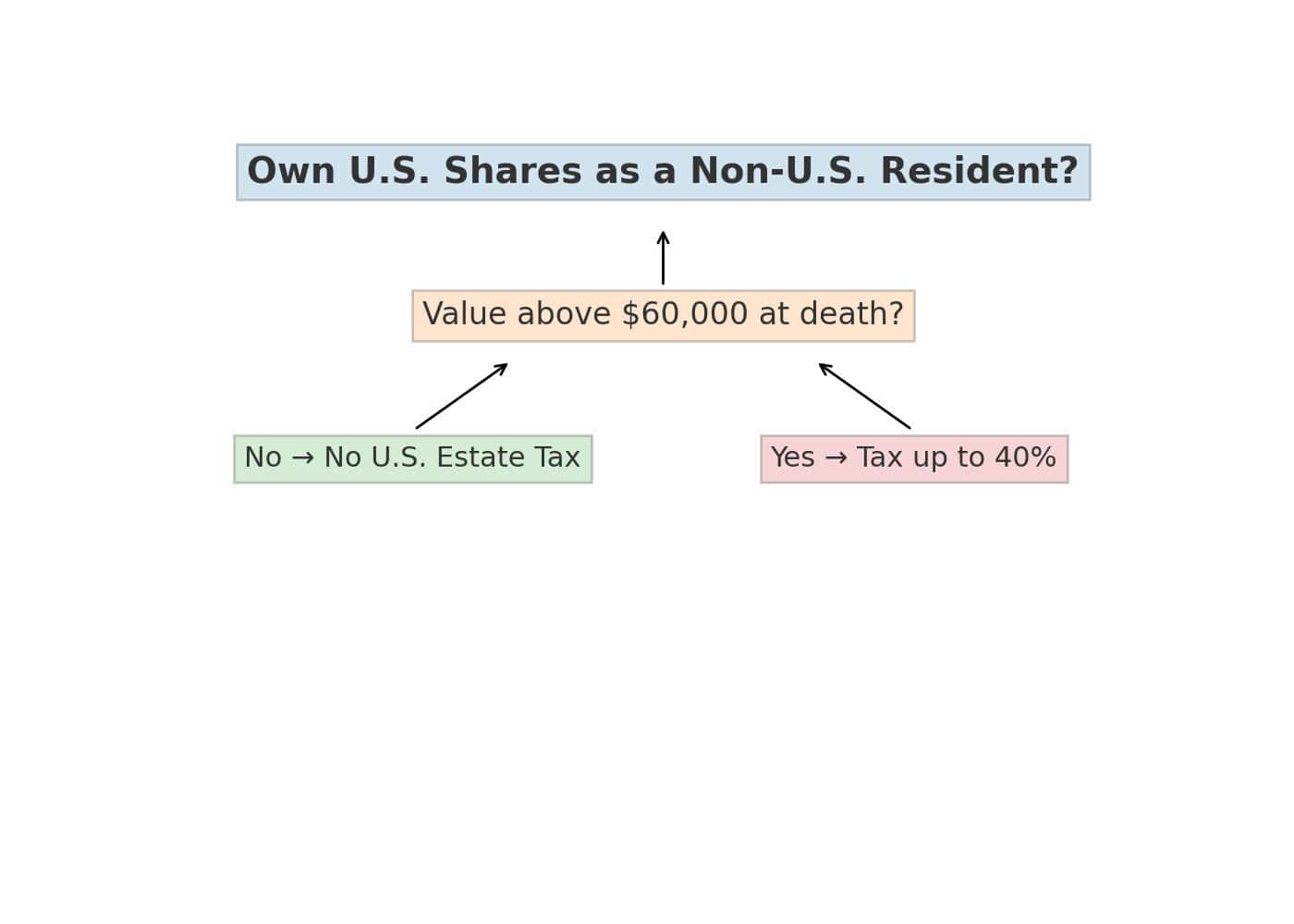

The U.S. government levies an estate tax on certain assets owned by non-U.S. residents at the time of their death.

For non-resident, non-U.S. citizens (NRNCs), the rules are far stricter than for American citizens.

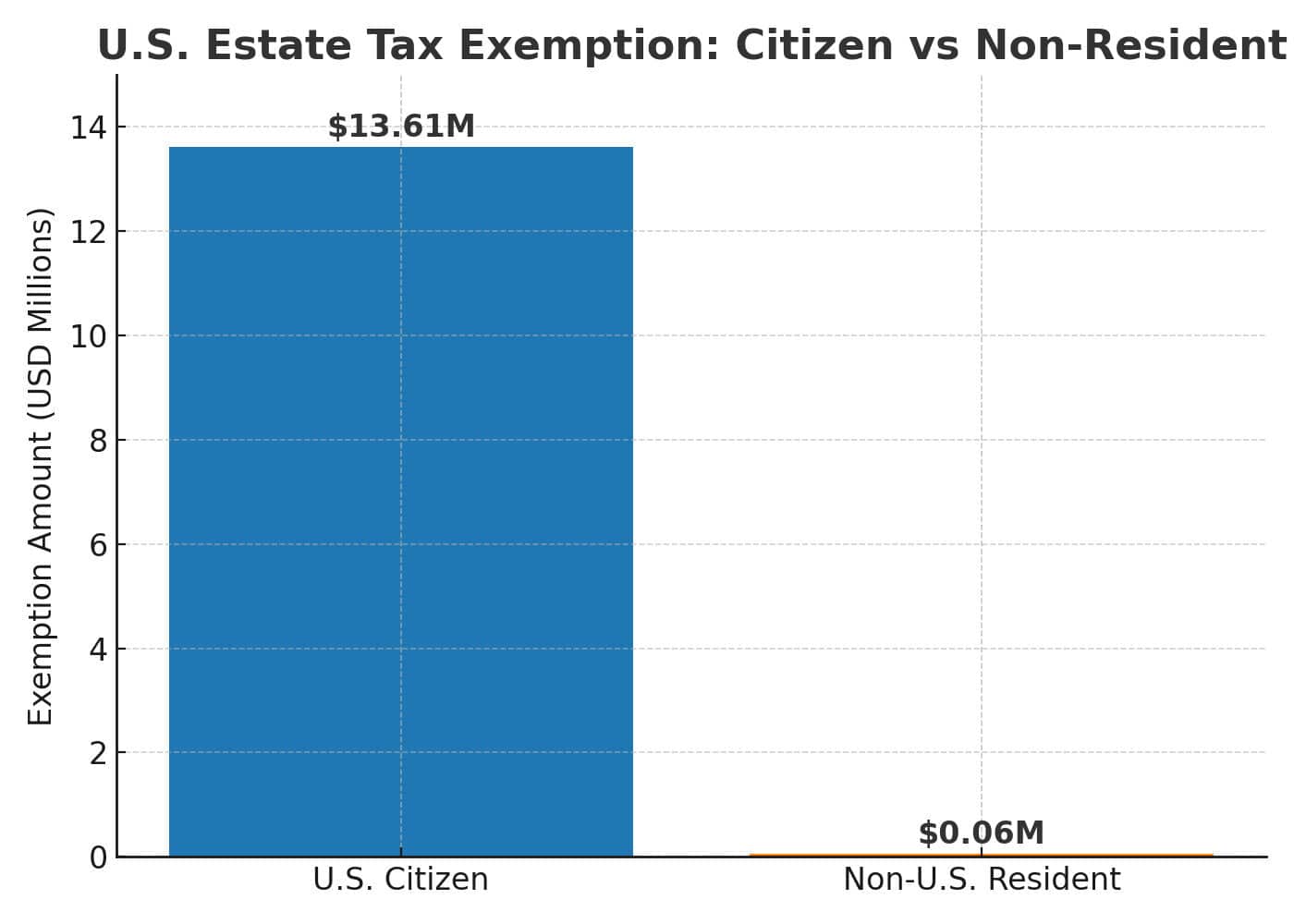

- U.S. citizens currently have an estate tax exemption of $13.61 million (2024 figures).

- NRNCs have an exemption of just $60,000.

- Anything above that is taxed at rates of up to 40%.

What Counts as a U.S. Asset?

For expats, the tax applies to U.S.-situated property, including:

- Shares in U.S. companies (Apple, Microsoft, Tesla, etc.)

- U.S.-listed ETFs and mutual funds

- Certain bonds and tangible property located in the U.S.

It doesn’t matter if you live in Dubai, London, or Hong Kong if you own these directly in your name and you pass away, your estate could face this tax.

A Simple Example

Let’s say you live in the UAE and own $500,000 of U.S. shares in your personal brokerage account.

If you pass away:

- The first $60,000 is exempt.

- The remaining $440,000 could be taxed at up to 40%.

That’s $176,000 going to the IRS — before your family even receives the shares or the cash.

Why Expats Often Miss This

Many expatriates assume they are safe from U.S. tax rules because they don’t live in the U.S. or file U.S. taxes.

The estate tax is different — it’s based on where the asset is situated, not where you live.

How to Reduce the Risk

The good news is there are legitimate, compliant ways to avoid or reduce this exposure:

- Hold U.S. investments via a tax-efficient structure (e.g. an offshore portfolio bond) so the shares are not directly in your name.

- Invest through non-U.S.-domiciled ETFs or funds that still give U.S. market exposure but are listed in Europe or elsewhere.

- Use appropriate estate planning tools such as trusts, depending on your situation.

So….

U.S. shares can be a fantastic investment ,but for expatriates, holding them directly could leave your family with a surprise tax bill.

By planning ahead and using the right structures, you can still enjoy the benefits of investing in the world’s biggest stock market without leaving an unexpected tax headache behind.

Disclaimer: This content is for general information only and does not constitute tax or legal advice. Always seek advice from a qualified professional before making investment or estate planning decisions.