Should You Overpay Your Mortgage or Invest the Money?

When you find yourself with extra cash each month, perhaps from a raise, bonus, or savings, the question often arises: Should I overpay on my mortgage or invest the money? Both options can build wealth over time, but the right choice depends on your financial goals, risk tolerance, and current interest rates.

In this article, we’ll break down the theory behind overpaying your mortgage, compare it with investing, and help you make an informed decision with a practical example.

The Theory Behind Overpaying Your Mortgage

Overpaying your mortgage simply means paying more than your required monthly payment. The surplus goes directly toward reducing your loan balance, which reduces the interest you’ll pay over the life of the loan.

Pros of Overpaying Your Mortgage

- ✅ Guaranteed Return: Paying off debt gives you a return equal to your mortgage interest rate.

- ✅ Reduces Interest Over Time: The sooner you reduce your balance, the less interest you’ll pay over the term.

- ✅ Debt-Free Sooner: This can offer peace of mind and financial freedom earlier in life.

- ✅ Improves Equity: Increases your ownership in your home, which could help if you need to remortgage or sell.

Cons of Overpaying Your Mortgage

- ❌ Opportunity Cost: You might earn more by investing the money elsewhere.

- ❌ Reduced Liquidity: Once you overpay, that money is locked into your property.

- ❌ Potential Early Repayment Charges (ERCs): Some mortgages penalize overpayments over a certain amount.

- ❌ Missed Tax Advantages: In some countries, investment returns can be more tax-efficient than mortgage savings.

Comparing Overpaying a Mortgage vs. Investing: An Example

Let’s take a practical look:

- Mortgage balance: £250,000

- Interest rate: 4%

- Remaining term: 25 years

- Monthly overpayment/investment amount: £500

- Investment return assumption: 7% annually (average long-term equity market return)

Scenario A: Overpay Mortgage

Overpaying £500/month could save ~£47,000 in interest and reduce the mortgage term by about 6 years.

Scenario B: Invest the £500/month

Investing £500/month over 25 years at a 7% return grows to ~£409,000.

The Trade-Off

| Strategy | Total Saved/Gained | Liquidity | Risk |

|---|---|---|---|

| Overpay Mortgage | ~£47,000 interest saved + 6 years early repayment | Low (money tied in house) | Low (guaranteed saving) |

| Invest the Difference | ~£409,000 (gross, before tax) | High (accessible) | Medium-High (market risk) |

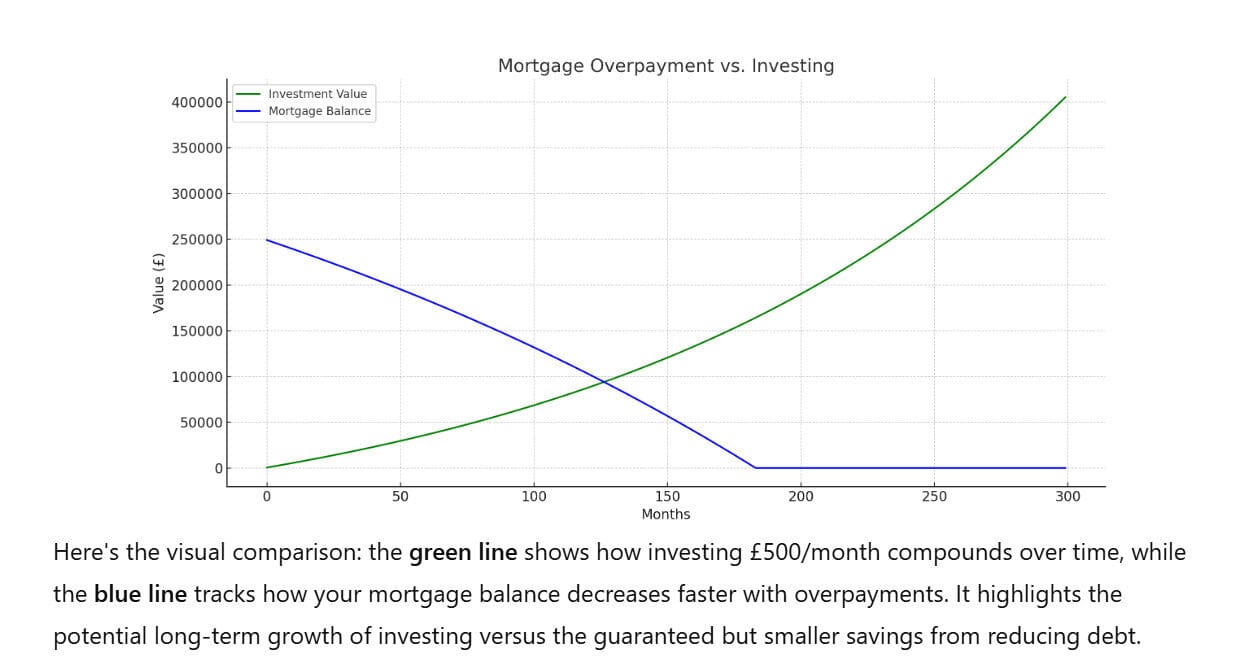

Visual Comparison: Mortgage Overpayment vs. Investing

Here’s a simplified visual of how the investment would grow vs. the mortgage balance decreasing:

Tip: If your mortgage rate is below 3–4%, investing might deliver higher long-term gains,but it comes with risk.

So, Which Should You Choose?

Consider overpaying your mortgage if:

- You value being debt-free early.

- Your mortgage rate is relatively high.

- You’re risk-averse and prefer guaranteed savings.

Consider investing if:

- You can stomach short-term market volatility for long-term gains.

- Your mortgage rate is low (below 3.5%).

- You’ve already built an emergency fund and aren’t constrained by liquidity.

Final Thought

There’s no one-size-fits-all answer. In some cases, a hybrid strategy, splitting your extra money between overpayments and investing can offer the best of both worlds. It comes down to your personal goals, time horizon, and financial comfort.